WINNIE LAU

Your Financial Life Legacy Advisor

|

Hello, I'm Winnie Lau

Hi, I'm Winnie, I am the first and currently only woman to be certified in Canada under the Nelson Nash Institute as an Authorized Infinite Banking Concepts® Authorized Advisor. MY MISSION: To help business owners and families keep more cash flow by strategically mimicking what banks do. I help my clients achieve financial liberation WITHOUT relying on Wall Street, the government or traditional banking systems. WHY: The way people think about and use their money either; EMPOWERS or ENSLAVES HOW: I guide my clients in mindful preparation to avoiding financial gridlock traps. |

UNCOMMON ADVICE

=

UNCOMMON RESULTS

|

There is a way to be truly wealthy and financially empowered person that does not include burnout, overtime hours, anxiety, judgements and comparisons.

The secret is education, awareness and choice!

The #1 way to become FINANCIALLY EMPOWERED is through understanding the paradigm shift that is now occurring in banking AND implementing the Infinite Banking Concept® into your life.

The secret is education, awareness and choice!

The #1 way to become FINANCIALLY EMPOWERED is through understanding the paradigm shift that is now occurring in banking AND implementing the Infinite Banking Concept® into your life.

WINNIES' VISION:

To nurture business owners and families in the art of financial empowerment. Regardless of income, many people secretly feel dis-empowered and out-of-control with purchases and investments.

The Infinite Banking Concept® changes this reality.

ABOUT WINNIE'S PRACTICE:

|

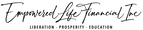

Winnie and her colleague Richard graduating as

Infinite Banking Concept® Practitioners in 2010 |

As a Financial Family Advisor, I guide you in discovering, from the depths of your being, throughout your life and without a doubt that:

Wealth & Well-being is NOT about how much money you make!

It IS about Financial Empowerment

i.e) choices many Canadians are not aware that they have.

Wealth & Well-being is NOT about how much money you make!

It IS about Financial Empowerment

i.e) choices many Canadians are not aware that they have.

A little bit about Winnie:

One of my most memorable experiences at age 8 or 9 was climbing up on the kitchen cupboards to find my parents' tin of money to give to my friend Mark. This was my natural response to his suffering from a broken arm. I wanted him to get whatever he needed to take away the pain and feel better. My parents tin of money was the first thing I thought of!

My desire to help and heal others did not leave me. I was accepted at age 23 to attend a Traditional Chinese Medicine school in Victoria but my life choices led me to become a mother at age 23 instead.

I did not go back to pursue healing the body, Instead, I was led to pursue the idea I had at the age of 8 or 9 - that money can heal. Really, it is the 'idea' and beliefs we have about money that create our suffering. Money does what we want it to and it is not as naive as it sounded to my parents or teachers at the time that money could help Mark.

The suffering of others has always brought me to the natural curiosity of:

Out of my own experience, I learned some of the answers to these important questions from a financial suffering point of view. Growing up I was not educated in a way that encouraged me to keep my money or use it to my advantage.

At age 24, having just become a single parent, I was $10,000 in debt, making $9 per hour and living paycheque to paycheque. It was the 3rd time I was in debt, and I did not know how to get out of what seemed like a hopeless cycle. At this point, I made the decision to live an empowered life rather than suffer under these financial circumstances,

Everything after my CHOICE to live an empowered life led me to become a healer in the world of finances.

One of the strategies I pursued at age 26 was Real Estate investing. In this pursuit, I met so many amazing people, grew my thinking in leaps and bounds, discovered what I was good at and developed an extensive understanding of a certain set of financial tools.

But, when the RealEstate markets fell in 2008-2009, at age 35, I became aware of a subtler sense of slavery than I had felt when I was living paycheque to paycheque. Being in business with the banks - with credit cards, bank overdrafts and the 9 different bank accounts I had crushed my sense of new found empowerment. I felt out of control and paralyzed; If I sold my properties, I stood to lose tens of thousands and the rental market was so depressed I could not cover my mortgage costs. I was caught! - The banking industry itself, and the 'retail' industry of housing, enticed me back into cycles of debt and repayment that left me feeling helpless and catching up AGAIN!.

These painful life experiences, however led me to discover one of the best tools to becoming empowered with finances - The Infinite Banking Concept®. It is a brilliantly conceived concept, conceived by R. Nelson Nash and born out of his suffering and life experience. It is with this as a primary tool, and its' many uses, that I have chosen to serve humanity and end cycles of financial anxiety and suffering.

One of my most memorable experiences at age 8 or 9 was climbing up on the kitchen cupboards to find my parents' tin of money to give to my friend Mark. This was my natural response to his suffering from a broken arm. I wanted him to get whatever he needed to take away the pain and feel better. My parents tin of money was the first thing I thought of!

My desire to help and heal others did not leave me. I was accepted at age 23 to attend a Traditional Chinese Medicine school in Victoria but my life choices led me to become a mother at age 23 instead.

I did not go back to pursue healing the body, Instead, I was led to pursue the idea I had at the age of 8 or 9 - that money can heal. Really, it is the 'idea' and beliefs we have about money that create our suffering. Money does what we want it to and it is not as naive as it sounded to my parents or teachers at the time that money could help Mark.

The suffering of others has always brought me to the natural curiosity of:

- how can the suffering stop?

- what can be done?

- what are the solutions?

Out of my own experience, I learned some of the answers to these important questions from a financial suffering point of view. Growing up I was not educated in a way that encouraged me to keep my money or use it to my advantage.

At age 24, having just become a single parent, I was $10,000 in debt, making $9 per hour and living paycheque to paycheque. It was the 3rd time I was in debt, and I did not know how to get out of what seemed like a hopeless cycle. At this point, I made the decision to live an empowered life rather than suffer under these financial circumstances,

Everything after my CHOICE to live an empowered life led me to become a healer in the world of finances.

One of the strategies I pursued at age 26 was Real Estate investing. In this pursuit, I met so many amazing people, grew my thinking in leaps and bounds, discovered what I was good at and developed an extensive understanding of a certain set of financial tools.

But, when the RealEstate markets fell in 2008-2009, at age 35, I became aware of a subtler sense of slavery than I had felt when I was living paycheque to paycheque. Being in business with the banks - with credit cards, bank overdrafts and the 9 different bank accounts I had crushed my sense of new found empowerment. I felt out of control and paralyzed; If I sold my properties, I stood to lose tens of thousands and the rental market was so depressed I could not cover my mortgage costs. I was caught! - The banking industry itself, and the 'retail' industry of housing, enticed me back into cycles of debt and repayment that left me feeling helpless and catching up AGAIN!.

These painful life experiences, however led me to discover one of the best tools to becoming empowered with finances - The Infinite Banking Concept®. It is a brilliantly conceived concept, conceived by R. Nelson Nash and born out of his suffering and life experience. It is with this as a primary tool, and its' many uses, that I have chosen to serve humanity and end cycles of financial anxiety and suffering.